Created by Financial Professionals

for Professionals Like You

Unitifi knows what you’re up against day in and day out being all things to all people. That’s why we developed a proprietary FinTech solution delivering solid foundational data to clearly and accurately identify individual financial beliefs and behaviors for better advising.

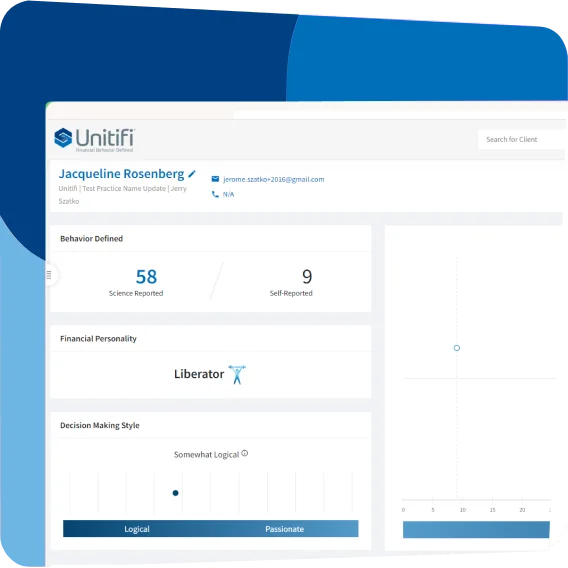

What’s truly expected of you is delivered with Unitifi through a simple assessment and individualized investor snapshots.

Increase client satisfaction & retention rates

Maximize advisor skills & influences

Reduce litigation risks & strengthen compliance

Integrate with trusted software solutions

Add value to your reputation & brand

Investor assumptions meet behavioral data defined by science

What Makes Unitifi Different Makes YOU Successful

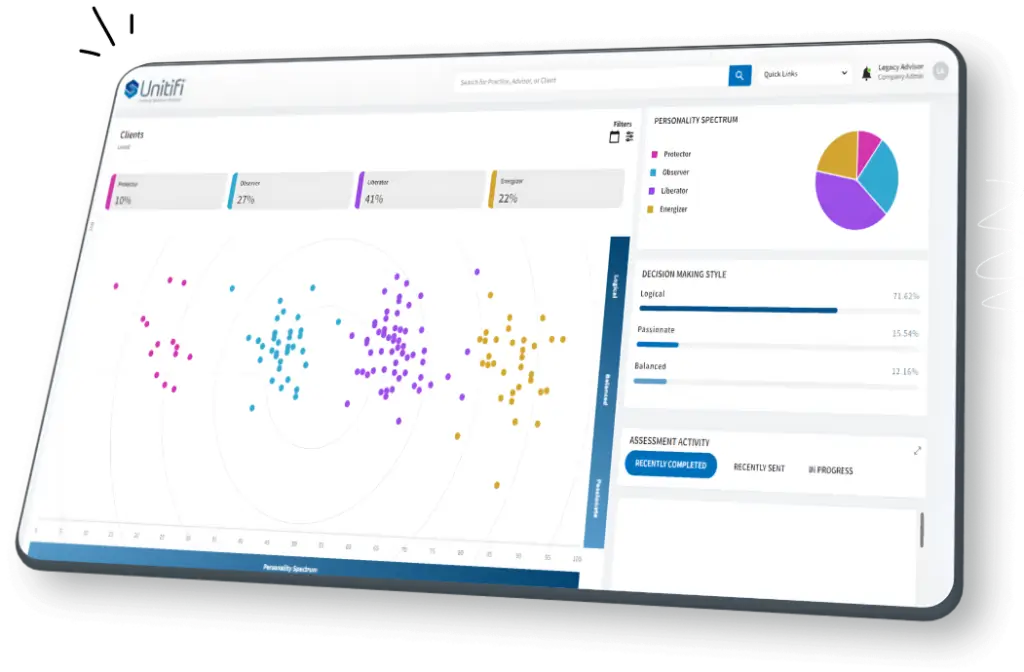

Investor snapshots & comparisons

Instantly generate intuitive investor snapshots from a single dashboard with precise personality insights specific to beliefs and responses related to investments when financial stress and volatility are applied. Easily compare results of multiple clients to understand overlapping financial personalities and behaviors.

Financial Firms

Financial Professionals

99% science-based

assessment accuracy

Backed by science, our proprietary algorithm is statistically valid. It instantly generates highly accurate, unbiased, and easily actionable information.

Financial Firms

Up to 30% savings on E&O insurance

The overall litigation-reducing potential of our platform is recognized by Lockton Affinity – the national administrator of Lloyd’s of London. Financial organizations that utilize Unitifi’s FinTech software can experience financial benefits.

Requires little to no onboarding to use

Let’s you white-label the user experience

Provides CDD & KYC documentation

What Our Clients Say

As the national administrator for Lloyd’s of London’s Investment Advisor E&O program, we understand that claims happen when communication breaks down between the advisor and investor. It’s critical for any professional advisor to understand his/her client’s investing ‘personality’. We are extremely impressed with the science behind the Unitifi risk mitigation software. Unitifi’s tools not only help the advisor understand what makes the client tick, but it also provides a clean summarized profile to assure the advisor and client remain on the same page during the entire engagement. Simply put, we think an advisor utilizing Unitifi’s platform is a better risk than an advisor not using it, therefore, we offer advisors utilizing Unitifi’s tools lower premiums when applying to our program.

In the 26 years since I began my career in the Financial Services Industry, I can say without a doubt that your assessment is one of the most powerful tools I have ever seen in aiding me to serve my clients. As a Certified Financial Planner professional and fee-based Registered Investment Advisor, the fiduciary standard is of utmost importance to me. The assessment results enable me to not only understand my clients objectively, but also provide subjective information to ensure my client’s interests always come first.

I think Unitifi’s product is unique in the industry and will significantly help me - especially as the new fiduciary rules begin. I bought the program and will use it with my approximately 1000 clients. Based on what I’ve seen so far, I feel it will especially help my 401k plans and their participants.

FAQ

Understanding your clients’ financial behaviors and beliefs is crucial for providing tailored advice that truly resonates with their needs. Unitifi’s financial behavior assessment offers a 99% accuracy rate, ensuring you have the most reliable data to guide your clients effectively. By identifying deeply ingrained financial beliefs, you can offer personalized advice that enhances client satisfaction and retention.

Unitifi goes beyond generalized risk assumptions by uncovering financial behavioral attributes that are triggered during market volatility. This allows you to anticipate and manage client reactions more effectively. With Unitifi’s proprietary FinTech solution, you can provide reassurances and strategies tailored to each client’s unique financial behavior, ensuring they remain confident and steady even in uncertain times.

During periods of financial stress, clients may exhibit behaviors they aren’t even aware of. Unitifi’s assessment provides clear, accurate data on these behaviors, enabling you to address concerns proactively. By understanding individual financial beliefs, you can offer targeted advice and support, reducing anxiety and helping clients stay focused on their long-term financial goals.

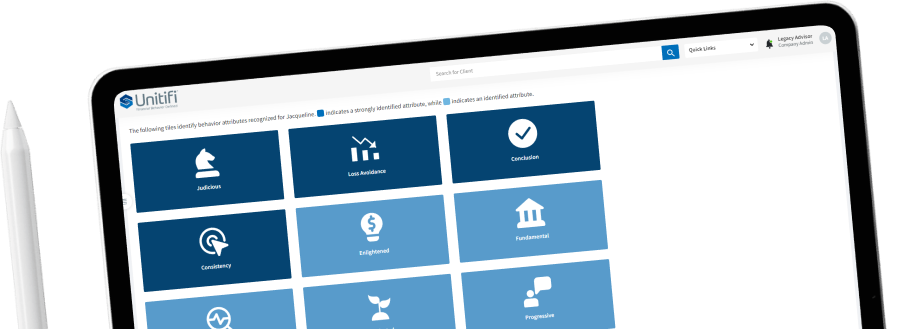

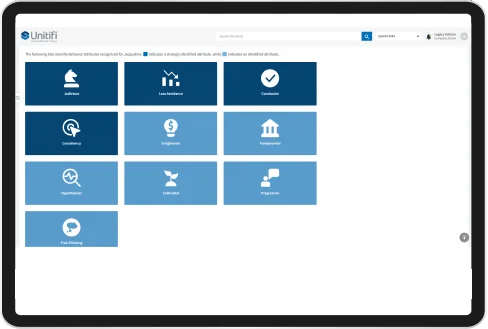

Unitifi employs a simple yet comprehensive assessment to track financial behaviors. This process creates individualized investor snapshots, providing detailed insights into each client’s financial beliefs and behaviors. These snapshots help you tailor your advice and strategies, ensuring they align with your clients’ unique profiles and improving overall advising effectiveness.