Tour the Dashboard

Unitifi Your Client-Advisor Relationships

One simple assessment. Full financial behavior transparency.

The Value of Behavior-Based Advising

The faster financial firms and professionals truly know their clients, the better.

Unitifi’s behavior-based approach to advising goes beyond a generalized number to uncover financial behavioral attributes triggered when market volatility is experienced.

You know, those deeply ingrained financial beliefs even clients may not realize influence investment behavior.

Our proprietary algorithm and reporting tools deliver targeted financial behavioral data plus communication preferences and tips with 99% accuracy. And we’re happy to show you exactly how it works.

Know Your Clients in Minutes & Hours, Not Weeks (If Ever)

1. Send the Unitifi Assessment

A simple 20-point questionnaire that reveals complexities typical financial firms and professionals struggle to pull out of clients and prospects can be completed in as little as 3-7 minutes.

Top ways the Unitifi Assessment is sent to attract and retain clients:

- Digital ad lead generation campaigns

- 1:1 LinkedIn, email, or text marketing strategies

- Re-engage orphaned clients & prospects

- Connect with current client beneficiaries

There’s no off-putting financial jargon, no intrusive proprietary questions, and the assessment can easily be completed from any device.

The Unitifi assessment is the perfect, no-hassle tool to engage new or orphaned prospects, current clients and their potential beneficiaries, partnered investors, and more.

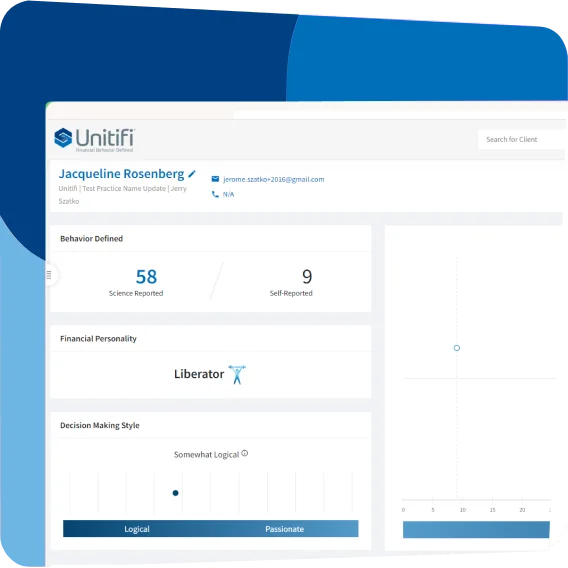

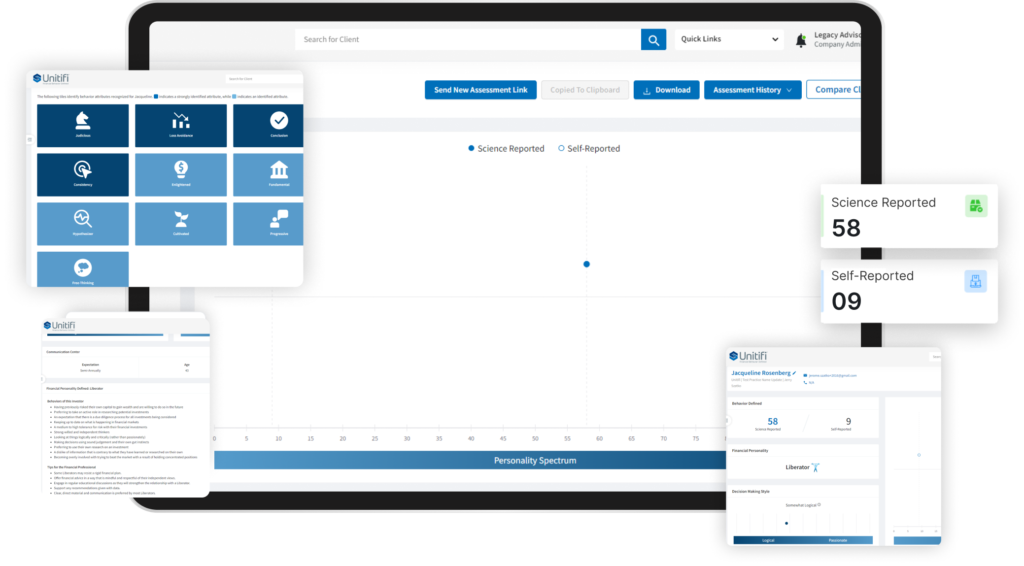

2. Receive the Investor Snapshot

Completed assessments instantly process through our proprietary Unitifi Consumer Insight Tool, commonly called “you see it” or UCIT.

What’s generated is an Investor Snapshot that is sent to you and the client or prospect. Key aspects that initially intrigue recipients:

- Investment personality type

- Self-reported vs. science reported results

- Recognized behavioral attributes

- Advisor tips & communication recommendations

3.Discuss snapshot results with client or prospect

The Investor Snapshot’s user-friendly accuracy puts professionals in a better position to engage in more meaningful and productive conversations with investors from the jump.

You’ll already have a solid sense of their financial personality and communication preferences. And that allows you to add whatever personal touches to the agenda and dialogue your client or prospect will actually resonate with and appreciate.

Know clients’ financial behaviors completely and target communications effectively to strengthen, retain, and grow your book of business with Unitifi.

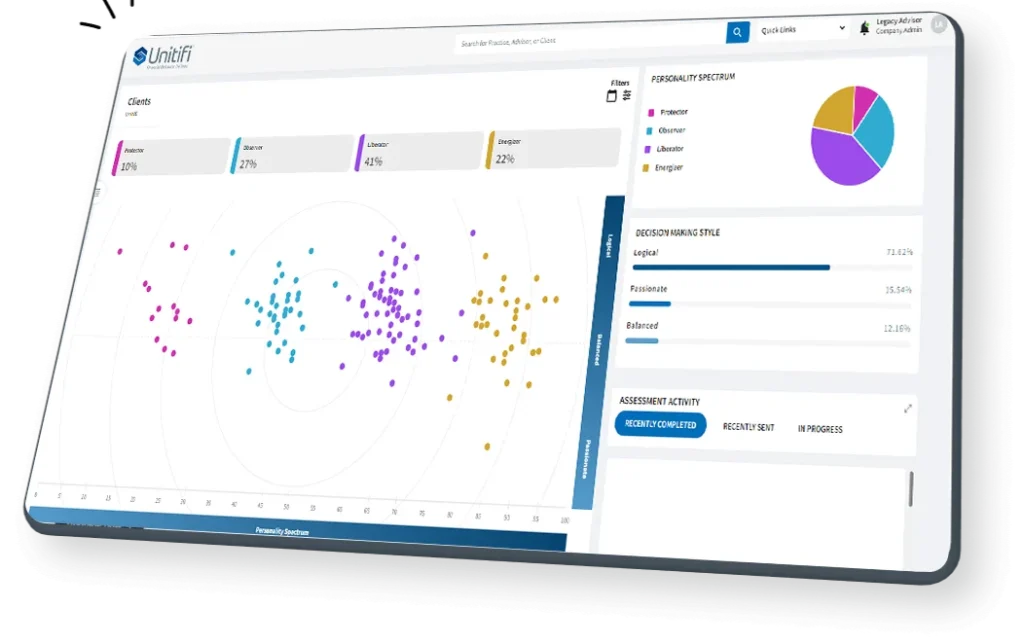

Unitifi's Financial Personality Profiles

The way a person behaves at a dinner party is often different, in big or small ways, from how they behave with their finances.

That’s why Unitifi focuses directly on financial behaviors to help professionals segment client lists between four personality types and up to 40 behavioral attributes in addition to actionable communication tips and recommendations.

PROTECTORS

- Preserves wealth

- Values objectivity

- Values expertise

- Worried/cautious

- Low financial stress

OBSERVERS

- Delays decisions

- Long-term planner

- Values opinions

- Values innovation

- Overestimates risk

LIBERATORS

- Self-made wealth

- Strong-willed individual

- Values originality

- Trusts in self

- More financial stress

ENERGIZERS

- Prefers control

- Values engagement

- Values involvement

- Active/aggressive

- High financial stress