Know Your Clients. Completely.

Who is Unitifi?

How do you handle risk? Let's find out

We help financial professionals understand their clients' behavior.

More importantly, Unitifi helps financial firms and professionals develop meaningful and productive client relationships. The foundation of our method is our proprietary assessment generated by the Unitifi Consumer Insight Tool (UCIT).

Our team created UCIT (You See It) to capture and categorize individual investor financial behaviors with a focus on risk tolerance. Our 20-point questionnaire is designed to effectively identify and anticipate the investor’s behaviors—such as their financial decision making ability and communication preferences.

When your client completes the assessment, we use our algorithm to generate a detailed financial personality profile. The insight provided by the Unitifi Assessment is the ticket to knowing your clients completely. It also serves as a guide to assist with each individual’s investment decisions.

How Unitifi Works

First, a client completes the Unitifi Assessment.

Then, delivery of your client's Investor Snapshot.

Protector

Observer

Liberator

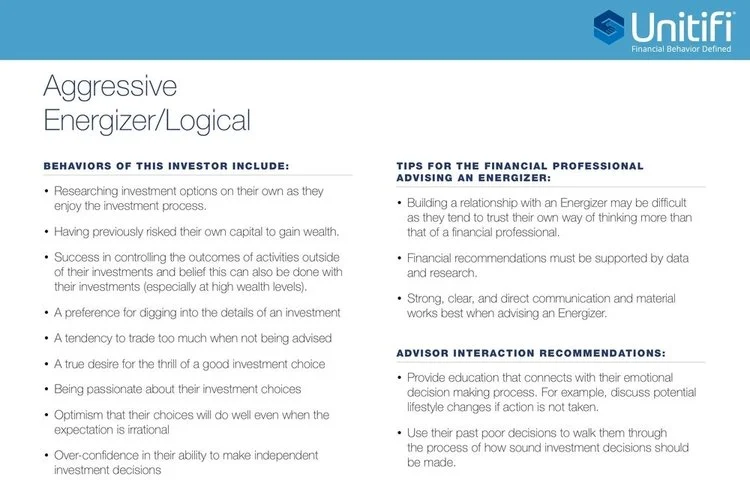

Energizer

Defining Financial Behavior Attributes

Our assessment identifies an investor’s financial personality as Protector, Observer, Liberator, or Energizer—on a spectrum ranging from conservative to aggressive. The more risk-tolerant the investor, the more aggressive the financial personality.

That’s just the start. Each Investor Snapshot also includes more nuanced details of your client’s financial self. These details allow us to help coach advisors on how to best engage with and grow client relationships – this guidance is unique to each client.

And finally, you both benefit.

- Enhance client on-boarding process

- Personalize communication

- Ability to integrate via API with FinTech platforms

- Reduce potential client litigation

- Target marketing efforts

- More behavior appropriate allocations

- Improve retention of clients and growth of managed assets

- Effectively match clients with right advisor

- Potential to reduce E&O insurance premiums

- And more...

Stay connected with your clients using common CRM integrations!

Our integration is live!